In India, small businesses and entrepreneurs are the backbone of the economy. To empower them, the Government of India has introduced several schemes. One of the most popular among them is the Prime Minister’s Employment Generation Programme (PMEGP Yojana). This initiative provides financial support to individuals who want to start their own business, thereby boosting self-employment and strengthening the Micro, Small, and Medium Enterprises (MSME) sector.

In this blog, we will explore the PMEGP Yojana in detail — its objectives, eligibility, benefits, loan structure, subsidy, and the application process.

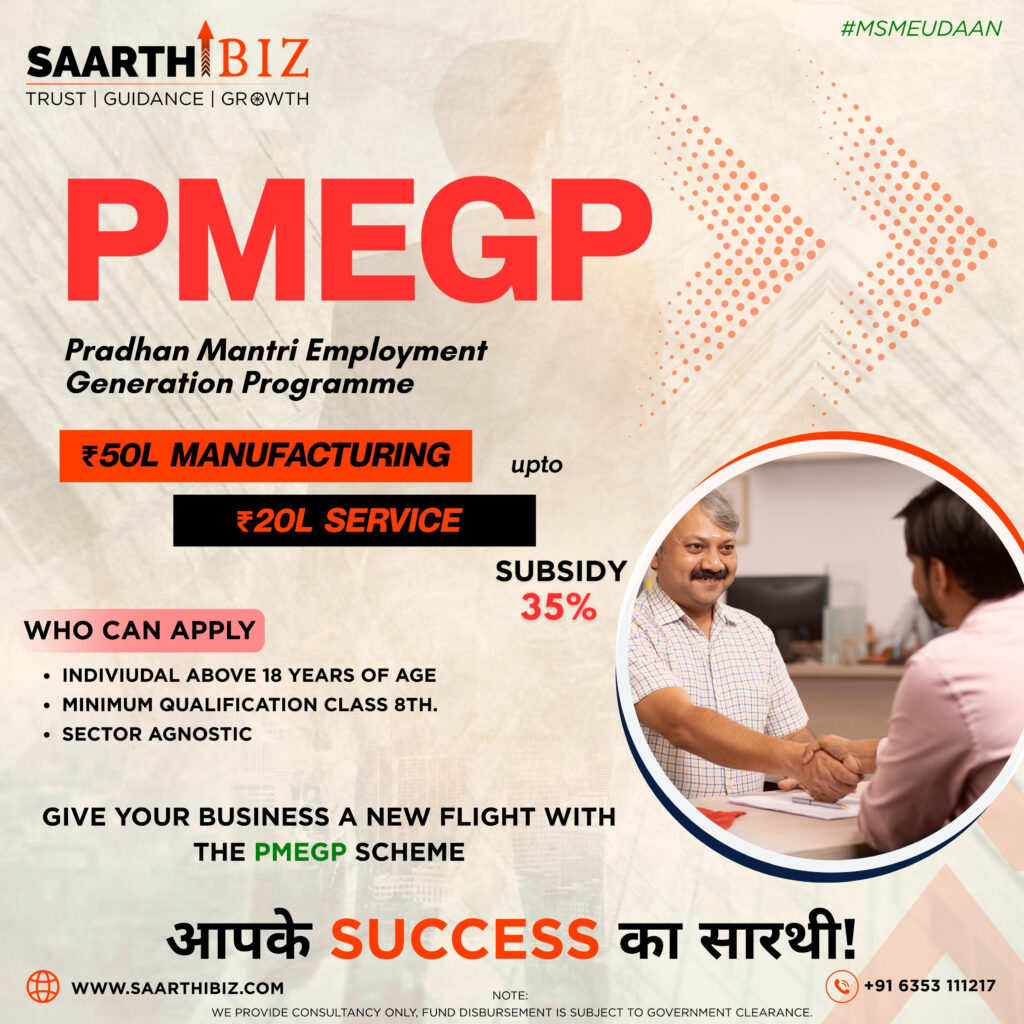

The Prime Minister’s Employment Generation Programme (PMEGP) is a credit-linked subsidy scheme launched in 2008. It is implemented by the Khadi and Village Industries Commission (KVIC) at the national level, while State KVIC Directorates, District Industries Centres (DICs), and State Khadi and Village Industries Boards manage it at the local level.

The scheme provides financial assistance to individuals and groups to set up new micro-enterprises in the manufacturing and service sectors. By doing so, it promotes entrepreneurship, reduces unemployment, and supports rural as well as urban development.

To generate sustainable employment opportunities in rural and urban areas.

To encourage entrepreneurship among youth and traditional artisans.

To provide credit support with subsidy for setting up micro-enterprises.

To strengthen the MSME sector, which is vital for India’s economic growth.

The PMEGP scheme is designed as a credit-linked subsidy programme. This means that beneficiaries have to contribute a portion of the project cost, while the rest comes as a bank loan and government subsidy.

Manufacturing sector: Up to ₹25 lakhs

Service sector: Up to ₹10 lakhs

General category: 10% of project cost

Special categories (SC/ST/OBC, women, ex-servicemen, physically handicapped, minorities, etc.): 5% of project cost

Urban area (General category): 15%

Rural area (General category): 25%

Urban area (Special category): 25%

Rural area (Special category): 35%

This structure ensures that individuals with limited capital can also start businesses with government support.

To apply under PMEGP, applicants must meet certain requirements:

Age Limit: Minimum 18 years.

Education: At least Class 8 pass for projects above ₹10 lakhs in manufacturing and ₹5 lakhs in services.

Business Type: Only new projects are considered. Existing units or those already receiving government subsidies are not eligible.

Eligible Entities:

Individual entrepreneurs

Self Help Groups (SHGs)

Charitable trusts

Societies registered under Societies Registration Act, 1860

Production Co-operatives

Financial Support: Easy access to loans with government subsidy.

Employment Generation: Helps youth and artisans create self-employment opportunities.

Low Own Contribution: Only 5–10% margin money needed.

Wide Coverage: Supports both rural and urban entrepreneurs.

Skill Development: Beneficiaries undergo training before starting their enterprise.

Support for Women and Weaker Sections: Higher subsidies for SC/ST/OBC, minorities, and women entrepreneurs.

The scheme covers a wide range of activities in manufacturing and services. Some examples include:

Manufacturing sector: Food processing, textile units, furniture making, engineering workshops, handicrafts, leather products.

Service sector: Beauty parlours, repair workshops, cyber cafés, courier services, transport facilities.

Note: Certain negative list activities (like liquor, tobacco, or banned items) are not allowed under PMEGP.

Aadhaar card / Voter ID / PAN card

Educational qualification certificates

Project report

Caste certificate (for special category)

Address proof

Passport size photographs

Apart from there, other documents are also required, our team will help you for the same.

he PMEGP Yojana is a golden opportunity for aspiring entrepreneurs and small businesses in India. With its low entry barriers, attractive subsidy, and wide coverage, the scheme is designed to promote self-employment and strengthen the MSME sector. Whether you are a young graduate, a woman entrepreneur, or a traditional artisan, PMEGP can help you turn your business idea into reality.

If you are planning to start your own enterprise, now is the right time to explore the PMEGP scheme and take advantage of the government’s support. If you want expert guidance for the process feel free to contact us over call or Whatsapp.

Office No. 404, Patel Avenue Near

Thaltej Metro Station, Ahmedabad,

Gujarat – PIN CODE – 380059

© 2025 Saarthibiz Consultancy Services Private Limited. All Rights Reserved.